Many U.S. corporations take advantage of loop holes and accounting tricks to avoid paying U.S. taxes. A favorite of these tricks is creating booking profits in countries with no or minimal taxes – known as tax havens. There are many watchdog organizations doing yeoman’s work in trying to uncover and expose just how much money is being booked offshore and how much tax is being avoided.

One of these watchdogs, the Citizens for Tax Justice, released a report that outlined the 30 companies with the most profits booked offshore. However, they were unable to calculate exactly how much tax is being avoided, because most of the companies obfuscate or even hide the information.

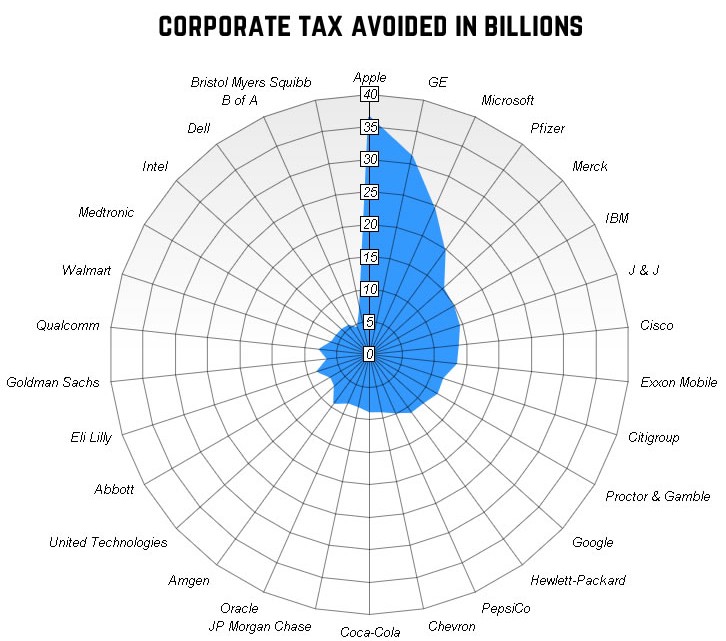

Still, rather than have a complete unknown, we at Safer America wanted tangible figures to see how much these companies COULD be avoiding. So, we decided to make estimates by employing similar methodology to that used in the study. In doing so, we found that these 30 companies could be avoiding an estimated $351.55 Billion in taxes. The Offshore Tax Data Project, inspired by the Offshore Tax Havens interactive graphic, was made in conjunction with the law firm of Gorman & Jones, PLC.

Methodology: Not all companies disclose the rate of foreign tax they paid on their offshore holdings. This makes concrete numbers difficult to come by. So, to calculate the estimated tax avoided for companies that do not disclose their foreign tax rate, we took the corporate tax rate of 35 percent and subtracted the average reported/implied rate (6.7%) of offshore taxes paid for all fortune 500 companies.

[table caption= “Estimated Tax Avoided of 30 Companies With The Most Offshore Cash”]

Company,Amount Held Offshore,# of Tax Havens,Reported Foreign Tax Rate Paid,Estimate Tax Avoided*

Apple, 111.3 Billion,3,2.30%,36.44 Billion

General Electric,110 Billion,18,N/A,31.13 Billion

Microsoft,76.4 Billion,5,3.10%,24.4 Billion

Pfizer,69 Billion,128,N/A,19.52 Billion

Merck,57.1 Billion,131,N/A,16.16 Billion

IBM,52.3 Billion,15,N/A,14.80 Billion

Johnson & Johnson,50.9 Billion,60,N/A,14.40 Billion

Cisco Systems,48 Billion,56,N/A,13.58 Billion

Exxon Mobil,47 Billion,38,N/A,13.30 Billion

Citigroup,43.8 Billion,21,8.30%,11.7 Billion

Procter & Gamble,42 Billion,32,N/A,11.88 Billion

Google,38.9 Billion,2,N/A,11.00 Billion

Hewlett-Packard,38.2 Billion,27,N/A,10.81 Billion

PepsiCo,34.1 Billion,137,N/A,9.65 Billion

Chevron,31.3 Billion,13,N/A,8.85 Billion

Coca-Cola,30.6 Billion,13,N/A,8.66 Billion

J.P. Morgan Chase & Co.,28.5 Billion,83,N/A,8.06 Billion

Oracle,26.2 Billion,6,4.50%,8 Billion

Amgen,25.5 Billion,8,0%,9.1 Billion

United Technologies,25 Billion,27,N/A,7.07 Billion

Abbott Laboratories,24 Billion,79,N/A,6.79 Billion

Bristol-Myers Squibb,24 Billion,10,N/A,6.79 Billion

Eli Lilly,23.74 Billion,26,0%,8.3 Billion

Goldman Sachs Group,22.54 Billion,15,N/A,6.38 Billion

Qualcomm,21.6 Billion,11,0%,7.6 Billion

Wal-Mart Stores,21.4 Billion,0,N/A,6.05 Billion

Medtronic,20.499 Billion,37,N/A,5.80 Billion

Intel,20 Billion,13,N/A,5.66 Billion

Dell,19 Billion,79,N/A,5.37 Billion

Bank of America Corp.,17 Billion,264,9.70%,4.3 Billion

Totals,1.1998 Trillion,1357,Avg 6.7*,351.55 Billion

[/table]

Estimated Savings Under President Obama’s Tax Proposal

President Obama’s recent proposal of a one time “transition tax” on offshore holdings is an admirable attempt to hold companies accountable for taxes owed. However, at 14%, it offers a significant tax cut on the 35% corporate tax rate. Using our tax owed estimations from above, we calculated how much these same 30 corporations would owe under the “transition tax” and how much they would save.

With our estimations, we found that these 30 companies would owe $140.3 billion under the transition tax. That sounds great, but that figure would represent a $211.34 Billion tax cut over what is currently owed.

Methodology: The transition tax is 14% less a tax credit of 40% of foreign tax paid. Again, if the company did not disclose their foreign tax rate, we used the fortune 500 average of 6.7% to calculate.

[table caption= “Estimate Tax Bill and Savings Under Obama Proposal”]

Company Name, Transition Tax Credit*, Taxes Due Under Obama Proposal, Estimated Savings ( In Billions),

Apple, 1.02 billion, 15.58 – 1.02 = 14.56 billion, 21.88

General Electric, 2.94 billion, 15.4 – 2.94 = 12.46 billion, 18.67

Microsoft, 947 million, 10.69 – 947 million = 9.74 billion, 14.66

Pfizer, 1.84 billion, 9.66 – 1.84 = 7.82 billion, 11.7

Merck, 1.53 billion, 7.99 – 1.53 = 6.46 Billion, 9.7

(IBM), 1.4 billion, 7.32 – 1.4 = 5.92 billion, 8.88

Johnson & Johnson, 1.36 billion, 7.12 – 1.36 = 5.76 billion, 8.64

Cisco Systems, 1.28 billion, 6.72 – 1.28 = 5.44 billion, 8.14

Exxon Mobil, 1.25 billion, 6.58 – 1.25 = 5.33 billion, 7.97

Citigroup, 1.45 billion, 6.13 – 1.45 = 4.68 billion, 7.02

Procter & Gamble, 1.12 billion, 5.88 – 1.12 = 4.76 billion, 7.12

Google, 1.04 billion, 5.44 – 1.04 = 4.40 billion, 6.6

Hewlett-Packard, 1.02 billion, 5.34 – 1.02 = 4.32, 6.49

PepsiCo, 913 million, 4.77 – 913 million = 3.85 billion, 5.8

Chevron, 838 million, 4.38 – 838 million = 3.54 billion, 5.31

Coca-Cola, 820 million, 4.28 – 820 million = 3.46 billion, 5.2

J.P. Morgan Chase & Co., 763 million, 3.99 – 766 million = 3.23 billion, 4.92

Oracle, 471 million, 3.66 – 471 million = 3.18 billion, 4.82

Amgen, 0, 3.57 billion, 5.53

United Technologies, 670 million, 3.5 – 670 million = 2.83 billion, 4.24

Abbott Laboratories, 643 million, 3.36 – 643 million = 2.71 billion, 4.08

Bristol-Myers Squibb, 643 million, 2.71 billion, 4.08

Eli Lilly, 0, 3.32 billion, 4.98

Goldman Sachs Group, 604 million, 3.15 – 604 million = 2.54 billion, 3.84

Qualcomm, 0, 3.02 billion, 4.58

Wal-Mart Stores, 573 million, 2.99 – 573 million = 2.41 billion, 3.64

Medtronic, 549 million, 2.86 – 549 million = 2.31 billion, 3.49

Intel, 536 million, 2.80 – 536 million = 2.26 billion, 3.4

Dell, 509 million, 2.66 – 509 million = 2.15 billion, 3.22

Bank of America Corp., 659 million, 2.38 – 659 million = 1.56 billion, 2.74

Totals, -,140.3 Billion, 211.34 Billion

[/table]

This study is an estimation in order to put numbers where they don’t currently exist. In some cases it could be extremely conservative (as many companies disclosed they pay nothing in foreign tax) or it may be slightly aggressive (again we used an average of the 55 fortune 500 companies who disclosed their foreign tax rate).

Until companies disclose all the information, all we can do is make estimates and projections.

*Data and Estimates compiled by Brian Beltz

No Comment